Promotional Pricing strategies. Companies can use several pricing techniques to stimulate early purchase: Loss-leader pricing – Supermarkets and department stores often drop the price on well Known brands to stimulate additional store traffic. This pays if the revenue on the addi-tional sales compensates for the lower margins on the) boss-leader items. Pricing strategy is a way of finding a competitive price of a product or a service. This strategy is combined with the other marketing pricing strategies that are the 4P strategy (products, price, place and promotion) economic patterns, competition, market demand and finally product characteristic.

To successfully use the economy pricing strategy and generate sufficient profit from low prices, you will need to have large sales volumes. Business example of economy pricing With all of its items priced at £1, variety store chain Poundland is a great example of a business which has maximised on economy pricing to become a major brand. New pricing plans attract customers by providing ownership options, mitigating uncertain value, offering price assurance, and overcoming financial constraints. Offer product versions. One of the easiest ways to enhance profits and better serve customers is to offer good, better, and best versions – or bronze, silver and gold if you prefer!

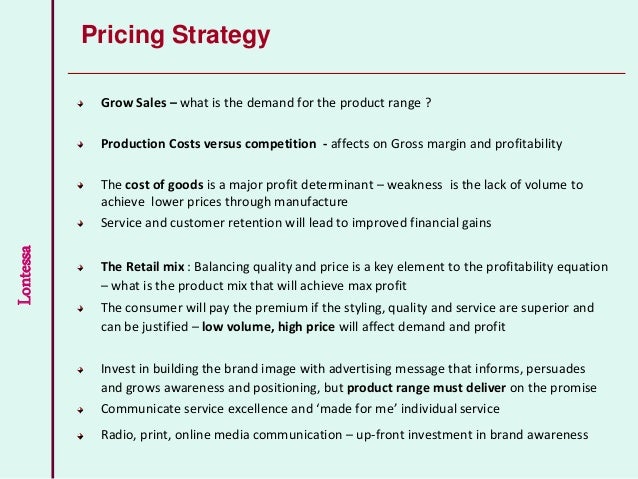

The goal for most businesses is to maximize both profit and growth. But often, these goals can contradict one another and it can be difficult to achieve profitable growth. The secret to achieving profitable growth is to price for long-term gains.

As we all know, pricing strategies are complex and need to take into consideration many factors such as cost, brand image, price elasticity of demand, and competitor pricing. Price can also be represented as a trade-off between short and long-term strategies. A high price can maximize short-term profit but can result in a loss of market share, and therefore have a negative effect on long-term profit. On the other hand, a low price maximizes long-term profit because it generally attracts more customers, allowing the business to gain market share, but it relies on your company having enough funds to be able to take on the short-term profit loss. With so many variables to keep in mind, it can seem overwhelming at times.

Here are our tips for ensuring your pricing strategy is a success.

5 Steps to Price for Long-Term Growth and Profit

1. Determine Your Strategic Priorities

Before you can even begin to think about pricing, you must determine the market you are attempting to achieve long-term growth in. This may seem obvious, but for companies that sell a variety of products it can be more difficult. For example, Macy’s sells everything from baby shoes to cookware; are they focused on growing market share in the footwear vertical, or in cosmetics? Different categories will require different strategies. For example, Amazon may not have the lowest price in certain product categories, but they make up for it in volume sales on lower-priced items in top categories.

Once you’ve established your strategic priorities, it’s important to keep a close eye on competitive movements across your most important categories. We’ll dive into that in more detail later in this article.

2. Establish Brand Positioning

Price undeniably influences consumer perception. Your desired brand positioning will determine what pricing route your products will take. If your brand aims to be high quality and luxurious, the products’ prices will reflect that with higher prices. To have long-term growth your brand will need to be targeted towards the high-end market segment.

On the other hand, if you want to be a low-cost provider in the market, you’ll need to sell in large volumes to drive down costs and sell at low prices. While the low prices attract customers, if the expected value surpasses the price, loyal customers can be gained and long-term growth in this market segment is possible.

While a bargain is always nice, consumers can perceive low cost items to be cheap which can damage a consumer’s view of the product and harm the brand equity. For example, if a consumer sees a pair of Nike shoes on sale for $40, it can set off some red flags. At first it may sound like a good deal, but are the shoes real or knock offs? And if they’re real, why have been paying more than twice the amount for Nike shoes in the past? Ultimately, price has the power to build or break a brand’s image.

3. Measure Price Elasticity

By measuring the price elasticity of demand of your products, you can determine how much the quantity demanded changes with a change in price. A product‘s demand is elastic (price sensitive) if it has available substitutes, doesn’t have a switching cost, or if it’s a luxury item. Knowing a product’s price elasticity will help you determine how sensitive demand is to any price changes. To price for long term growth, it is important to not dramatically change prices of price sensitive products as it will likely lower customer satisfaction and may turn customers away in the future. Price elasticity can help you determine the limits to price changes to optimize pricing strategy for long-term growth.

To measure price elasticity, the secret is to test pricing strategies to find the optimal price that maximizes sales and margins at the highest price consumers are willing to pay.

4. Managing Changes in Demand

It’s important to be agile and ready to adjust your pricing strategy in line with changes in the market. Pricing strategies may need to change based on seasonality of a product and due to other changes in demand such as new fashion trends. Think of Uber and Lyft’s surge prices during Friday evenings and events – when demand increases, so do prices. The use of dynamic pricing can be seen most obviously in seasonal products and on hot, trending products. It jump starts demand by luring customers with low prices during the slow period, while maximizing revenue with higher prices when demand is higher. Of course, anticipating trending products and categories is an important component to this, which brings us to our final tip…

Pricing Strategies Planning For Brand And Profit Maximization

5. Conduct Competitive Analysis

Everything is relative, so it’s important to stay aware of your price position relative to competitors over time. By running competitive analysis, you can discover your competitors’ pricing strategies and get the upper hand against your competition. Combine this with historical data to uncover trends that provide insights on how often your competitor runs promotions on what products and when.

With competitive analysis you can see which of your products are priced higher but are still winning in the market – this is where you command a premium, which helps you maximize your profits without sacrificing sales. Perhaps you are adding value in other ways such as stellar customer service, thereby justifying the higher price point to consumers. By capitalizing on this, you can create more profitable growth. On the other hand, there may be products that are more elastic where you need to be priced competitively.

Conclusion

The market is dynamic; therefore, price optimization is a continuous process. Luckily, you can analyze historical data and outcomes, in addition to real time market analysis, to help make strategic decisions. Measuring price elasticity and conducting competitive analysis can have a significant impact on your business by enabling you to grow profitably, without having to sacrifice one at the expense of the other.

Implementing successful pricing strategies can also help boost customer satisfaction and loyalty. And as we all know, a satisfied customer is more likely to return and spend more money in the future – a key contributing factor to long-term growth.

Pricing Strategies Planning For Brand And Profit Organizations

Never miss a pricing opportunity by automating the process with Wiser. Our automated competitive monitoring and repricing solutions allow you to keep up with the market in real-time, as well as design and test pricing strategies to ensure you’re on your way to profitable growth.

Pricing Strategies Planning For Brand And Profit And Loss

Contributing Writer: Patricia Montenegro